Fiat is commonly accepted as the default, and any recrimination or interrogation of the US monetary system is generally met with chuckles or exasperated sighs. No currency has proven superior, so what is there to discuss, really? Well, we could perhaps revisit the US Dollar Crisis to appreciate the mighty dollar’s most vulnerable moment and understand how gold backed-USD came to be fiat. If we did, we’d bump into the former French President Charles de Gaulle, who you can argue “shorted” the Dollar in 1965 and single handedly tipped USA into a fiat monetary system.

The Hardest Currency

A “hard” currency is a currency widely accepted as a means for payment for goods and services. Hard currencies are generally in high demand because they’re considered a safe haven for investors and are used in international trade and finance. A hard currency is less likely to experience large fluctuations in value, usually because they’re issued by countries with a strong economy, low inflation, political stability, and a consistent monetary policy.

Once upon a time the dollar was the hardest currency that ever existed. It was in fact the Goggins of currency. It stayed so hard it was actually deemed too hard and USA began to soften it. In 1948, the Marshall Plan was created to help rebuild war torn European countries and their battered economies by providing financial aid for infrastructure. Then in 1951, the Federal Reserve moved to reduce the amount of gold that backed the dollar, which increased the supply of dollars on the international market, while simultaneously rolling out the Mutual Security Act, which provided economic assistance to countries that bought US goods. Meanwhile, USA was developing a large trade imbalance. There were LOTS of dollars floating around the world, and that supply put downward pressure on the dollar. All told, the hardest currency in the world became just a tad soft. How soft? Soft enough that in the decade following, world leaders felt USD was overvalued, lost confidence in it and redeemed their greenbacks for gold in the period of US Dollar history referred to as the US Dollar Crisis.

Hey Dick, Give Me My Gold

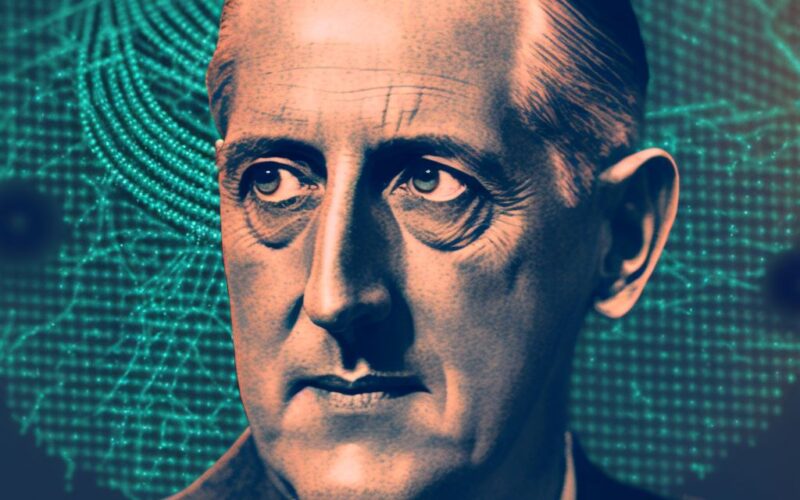

Before his term as president of France, Charles de Gaulle was a Brigadier General appointed as the head of the Free French Forces, which were made up of French resistance fighters and exiles opposing German occupation during World War 2. He knew too well the financial expense of war, and as he watched USA launch into costly conflict with Vietnam, he wondered “how is USA funding this?”.

The Bretton Woods Agreement, the international monetary agreement signed in 1944 that pegged the value of most major currencies to the US dollar, in turn pegged the dollar to gold at a fixed exchange rate of $35 per ounce. De Gaulle believed that the US was funding government and military expenses by exploiting this system. He reasoned USA was printing more dollars than it had gold to back them up, which led to an oversupply of dollars on the international market and consequently its overvaluation. Moreover with USA running a growing trade deficit, greenbacks were piling up all over the world as Americans exchanged dollars for foreign goods. This, along with dollar softening and USA’s generous global financial aid, made de Gaulle confident that the dollar was greatly diluted. But was it really possible that the hardest currency, backed by the richest, strongest nation in the world, that categorically insisted that every US dollar in existence was backed by gold, was not as America described it?

Yes, of course.

Charles de Gaulle saw through the smoke. So in 1965 Charles called up US President Richard Nixon and demanded $150MM worth of France’s gold which had been held in the Federal Reserve Bank of New York be returned to France. For the avoidance of any ambiguity it should be noted that this wasn’t a “when you have a moment”-type request; de Gaulle sent the French Navy to New York to collect the gold.

No Dollars Please

After Charles de Gaulle converted $150 million of France’s dollar reserves into gold, confidence in the US dollar and the Bretton Woods system eroded. The U.S. government agreed to the request, but a warning shot had been fired. France signaled they were not satisfied with the existing monetary system, which provided America with what De Gaulle described as “exorbitant privilege”- USA’s unique ability to simply print dollars to pay its debts while simultaneously exerting economic and political power on the rest of the world. He saw this rubric as a dangerous threat to global stability and an unfair advantage to the United States.

As other countries also began to question the value of the U.S. dollar and the stability of the Bretton Woods system, some countries, like Germany and Japan, began to accumulate gold and other currencies as an alternative to the dollar. The mighty dollar experienced a run, and although it’s almost never discussed there was a very brief period in the midst of the mayhem when countries and businesses did not accept USD to settle transactions. Middle East and African nations, particularly those that were major oil exporters, demanded gold or other currencies in exchange for their oil for fear of inflation and the further decline in value of the dollar.

Ultimately France’s demand for gold, along with similar demands from other countries, put pressure on the U.S. government to convert more dollars into gold, which led to a decline in the U.S. gold reserves. This, in turn, led to further loss of confidence in the U.S. dollar as a stable reserve currency, which lead to a run on the dollar, as other countries began to demand gold in exchange for their dollars. The United States was forced to devalue the dollar in 1971 by suspending the convertibility to gold, marking the end of the Bretton Woods system. Initially, Nixon claimed this was a temporary measure, but the Dollar permanently became a fiat currency, its value never again pegged to gold, and instead floated against other currencies.

This resulted in a period of inflation and currency fluctuations, as the value of the dollar was determined by market forces, rather than a fixed exchange rate. The U.S. dollar’s role as the world’s dominant reserve currency was also reduced as other currencies, such as the German Mark and Japanese Yen, began to play a more prominent role in international trade and finance.

And Now We’re Here

When people laugh off concerns that USD is no longer backed by gold, they give the impression that this has always been the case, that USD is fiat by design. But nothing could be further from the truth. USD is fiat because the world rejected the dollar’s overpriced valuation. We did experience a run on the dollar once before, and it thrust the US monetary policy into its current state. In turn, USA’s privileged ability to simply print dollars with no concern for gold backing has aided in the expansion of US debt. Those who argue that the gold backed system didn’t prevent deficit spending are partially right- USA ran a deficit prior by simply violating its promise to maintain a $35 per ounce gold peg.

All this to say, its terrifically unwise to suggest the dollar is inviolate; it has shown its weakness before. Historians would not argue that the dollar will never fall, but instead ask “when will the dollar fall”? I would ask in turn, “what will replace it”?

Yeah, Crypto

What are the chances the world will move from trusting $35 per ounce gold backed dollars, to not trusting dollar backing, to trusting fiat issued with the unconditional pledge of the USA, to USA publicly debating defaulting on its debts, to another fiat currency with no backing? We now have programmable, cryptographically secure digital currency that reduces transactional friction. We could asset back a cryptocurrency, or limit its liabilities by recording them on the blockchain to ensure target credit profiles. Why would we return to the volatility, uncertainty, and “trust me bro”-ism of antiquated currency?

Charles de Gaulle called for an “indisputable monetary base, said base not bearing the mark of any one country in particular”. He saw this as gold, but I wonder if Bitcoin, or a cryptocurrency tied to global hard assets, would have been his choice if the technology was available in 1965? If Bitcoin were available in 1965, would the US Dollar Crisis have lead us to Tokenize Earth?